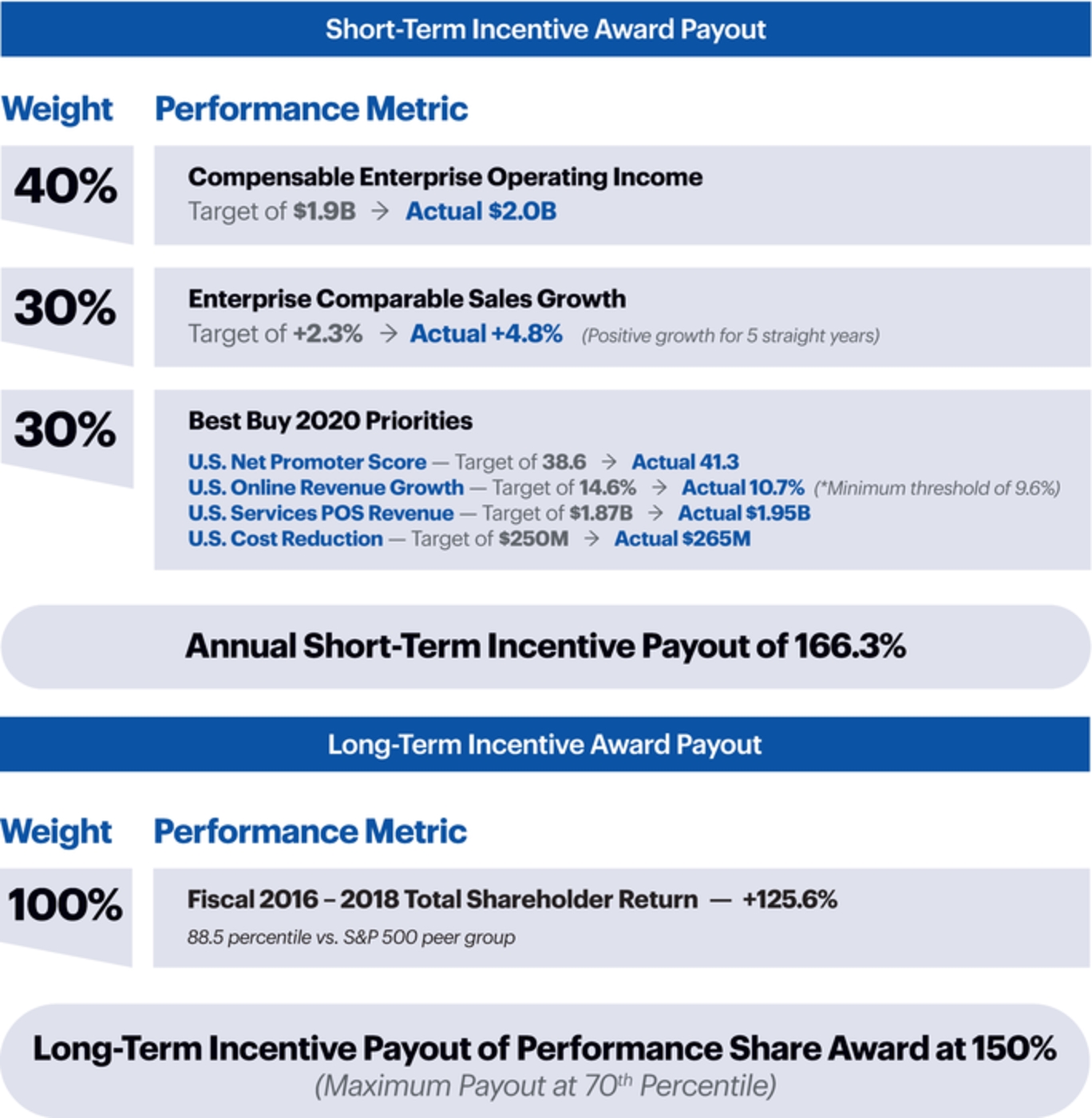

(2) | Compensable Enterprise Operating Income was determined based on the non-GAAP operating income from continuing operations of $1,953 million in our Annual Report on Form 10-K for fiscal 2018, adjusted for differences from budgeted | (2) | Compensable Enterprise Operating Income was determined based on the non-GAAP operating income from continuing operations of $1,988 million in our Annual Report on Form 10-K for fiscal 2019, adjusted for differences from targeted foreign exchange rates. |

| | (3) | Compensable Enterprise Operating Income was determined based on the non-GAAP operating income from continuing operations of $1,759 million in our Annual Report on Form 10-K for fiscal 2017, adjusted for differences from budgeted | (3) | Compensable Enterprise Operating Income was determined based on the non-GAAP operating income from continuing operations of $1,953 million in our Annual Report on Form 10-K for fiscal 2018, adjusted for differences from targeted foreign exchange rates. |

| (4) | U.S. Net Promoter score is a customer experience metric that measures a customer’s likelihood to recommend Best Buy. Methods of measuring U.S. Net Promoter Score can differ widely among different retailers, with many retailers measuring only purchaser satisfaction; however, we measure both purchasing and non-purchasing customers across our sales channels and therefore our total score may be lower than other companies as non-purchaser results are materially lower than those of purchasers. | (4) | U.S. Cost Reduction is the annualized year-over-year cost savings (compared to fiscal 2017 expense) as a result of cost reduction actions put into effect in fiscal 2018. |

| (5) | U.S. Services POS Revenue is the point of sales revenue associated with warranty, tech support, services, installation, delivery, and repair sales |

| (6) | U.S. Services Productive Revenue is the net revenue associated with sales of warranty, tech support, services, and installation, but excluding delivery and reimbursement revenue. |

| (7) | U.S. Cost Reduction is the annualized year-over-year cost savings (compared to fiscal 2018 expense) as a result of cost reduction actions put into effect in fiscal 2019. Cost savings must be permanent changes to the business. |

| | (5) | U.S. Net Promoter score is a customer experience metric that measures a customer’s likelihood to recommend Best Buy. Methods of measuring U.S. Net Promoter Score can differ widely among different retailers, with many retailers measuring only purchaser satisfaction; however, we measure both purchasing and non-purchasing customers across our sales channels and therefore our total score may be lower than other companies as non-purchaser results are materially lower than those of purchasers. The methodology utilized to measure Net Promoter Score at Best Buy was updated in fiscal 2018 to better align with industry standards, provide a more consistent and streamlined measurement system across experiences and to increase survey completion rates. The updated methodology was piloted in parallel with the previous methodology throughout fiscal 2017 in order to create a true baseline in establishing the fiscal 2018 performance target. |

| | (6) | U.S. Services Productive Revenue is the net revenue associated with sales of warranty, tech support, services, and installation, but excluding delivery and reimbursement revenue. |

Determination of Fiscal 2018 STI Target Payout. The Compensation Committee reviewed the target payout percentages for our NEOs under the fiscal 2018 STI plan as part of their review of the NEOs’ total fiscal 2018Determination of Fiscal 2019 STI Target Payout. The Compensation Committee reviewed the target payout percentages for our NEOs under the fiscal 2019 STI plan as part of its review of the NEOs’ total fiscal 2019 target compensation. The Compensation Committee generally applies a tiered approach in determining the potential target payout ranging from 100 percent to 200 percent of annual earnings based on each NEO’s eligible earnings as of the 15th day of each fiscal month. The specific target payout percentage for each NEO is determined based on external market data (including survey and proxy data from the Fortune 100 and our peer group) for equivalent roles, with emphasis placed on job value and internal pay equity among the NEOs. For fiscal 2019, the tiered target opportunities were 100 percent to 200 percent of salary. The target payout percentages for each NEO remained the same as in fiscal 2018, except for Ms. Scarlett whose STI increased at the same time as her base salary increased. For each of the metrics, the NEOs could earn zero to two times their weighted target payout percentage for that metric. The following chart shows fiscal 2019 STI opportunities and payments as a dollar value and percent of annual base salary (based on their eligible base salary as of the 15th day of each fiscal month): Name | Fiscal 2019

Annual

Base Salary(1) | Target

Payout

Percentage | Annual

Target

Payout

Value,

based on

Annual

Earnings | Fiscal 2019

Blended

STI Score | Fiscal 2019

STI

Payment | Fiscal 2019

STI Payment,

as a

Percentage

of Annual

Earnings | Mr. Joly | $ | 1,275,000 | | | 200 | % | $ | 2,550,000 | | | 1.663 | | $ | 4,240,650 | | | 333 | % | Ms. Barry | | 833,333 | | | 150 | % | | 1,250,000 | | | 1.663 | | | 2,078,750 | | | 249 | % | Mr. Mohan | | 891,666 | | | 150 | % | | 1,337,500 | | | 1.663 | | | 2,224,262 | | | 249 | % | Mr. Nelsen | | 740,000 | | | 100 | % | | 740,000 | | | 1.663 | | | 1,230,620 | | | 166 | % | Ms. Scarlett(2) | | 683,333 | | | 102 | % | | 693,750 | | | 1.663 | | | 1,153,706 | | | 169 | % | Ms. Ballard | | 891,666 | | | 150 | % | | 1,337,500 | | | 1.663 | | | 2,224,262 | | | 249 | % |

| (1) | Annual base salary is based on the average of each NEO's eligible earnings as ofNEO’s annual base salary rate on the 15thfifteenth fiscal day of each month for twelve months of the fiscal month. The specific target payout percentage for each NEO is determinedyear. This number may differ slightly from actual earnings listed in the Summary Compensation Table. |

| (2) | Ms. Scarlett’s Annual Base Salary and STI Target increased twice during fiscal 2019 based on external market data (including surveychanges in role and proxy data from the Fortune 100 and our peer group) for equivalent roles, with emphasis placed on job value and internal pay equity among the NEOs.

For fiscal 2018, the tiered target opportunities were 100 percent to 200 percent of salary. The target payout percentages for each NEO remained the same as in fiscal 2017. For each of the metrics, the NEOs could earn zero to two or three times their weighted target payout percentage for that metric (e.g. the U.S. Cost Reduction metric has a three times opportunity), but the maximum fiscal 2018 STI payout was capped at two times their target payout percentage.

The following chart shows fiscal 2018 STI opportunities and payments as a dollar value and percent of annual earnings (based on their eligible earnings as of the 15th day of each fiscal month):responsibilities.

|

Preview — Fiscal 2020 STI Performance Metrics. In December 2018, the Compensation Committee approved the performance criteria in the form of metrics for the fiscal 2020 STI, as follows: Compensable Enterprise Operating Income — 40% Enterprise Revenue Growth — 30% | | | | | | | | | | | | | | | | | | | | | | | | Name | | Fiscal 2018 Annual Earnings(1) | | Target Payout Percentage | | Annual Target Payout Value, based on Annual Earnings | Fiscal 2018 Blended STI Score | Fiscal 2018 STI Payment | Fiscal 2018 STI Payment, as a Percentage of Annual Earnings | | Mr. Joly | | $ | 1,258,333 |

| | 200 | % | | $ | 2,516,666 |

| | 1.829 |

| | $ | 4,602,983 |

| | 366 | % | | Ms. Barry | | 750,000 |

| | 150 | % | | 1,125,000 |

| | 1.829 |

| | 2,057,625 |

| | 274 | % | | Ms. Ballard | | 841,667 |

| | 150 | % | | 1,262,501 |

| | 1.829 |

| | 2,309,113 |

| | 274 | % | | Mr. Mohan | | 850,000 |

| | 150 | % | | 1,275,000 |

| | 1.829 |

| | 2,331,975 |

| | 274 | % | | Mr. Nelsen | | 683,333 |

| | 100 | % | | 683,333 |

| | 1.829 |

| | 1,249,817 |

| | 183 | % |

| | (1) | Annual earnings are based on the average of each NEO's annual base salary rate on the fifteenth fiscal day of each month for twelve months of the fiscal year. This number may differ slightly from actual earnings listed in the Summary Compensation Table.

| | | | |

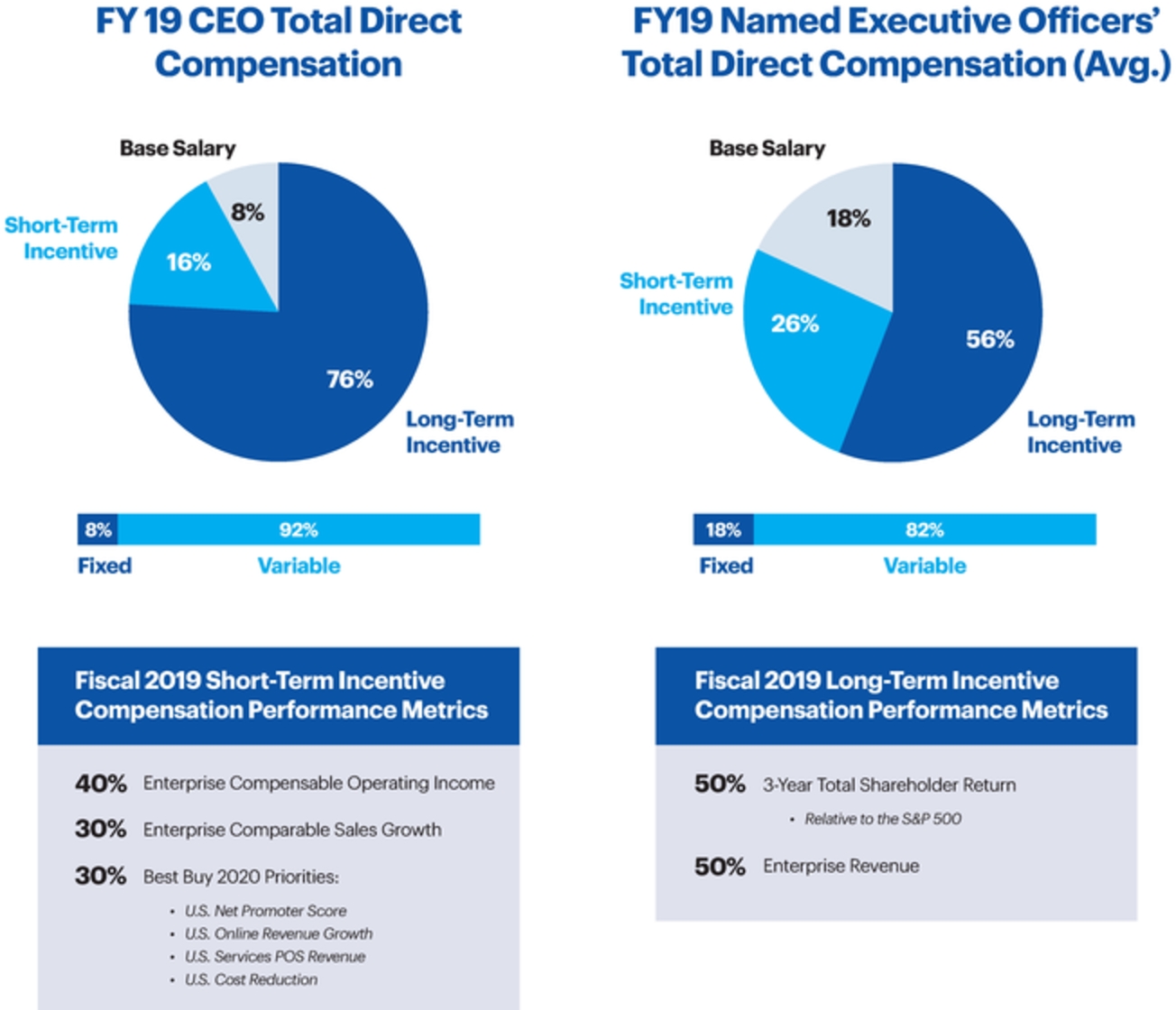

| | Fiscal 2019 STI Performance Criteria. In December 2017, the Compensation Committee approved the performance criteria in the form of metrics for the fiscal 2019 STI, and in March 2018, the Compensation Committee approved the target performance levels for each metric. The same metrics as used in fiscal 2018 will be used in fiscal 2019, as listed below:Proxy Statement

|

55

| Compensable Enterprise Operating Income - 40%

| Enterprise Comparable Sales Growth - 30%

Best Buy 2020 Priorities (maintaining the four fiscal 2018 priorities, except replacing Services Productive Revenue with Services Point of Sale Revenue) - 30%

|

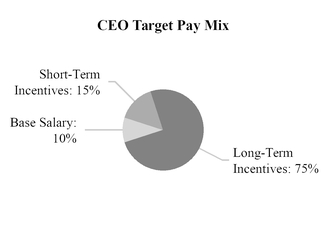

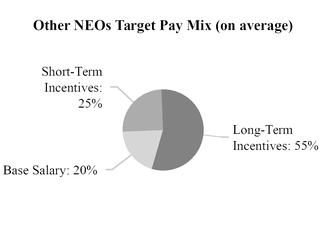

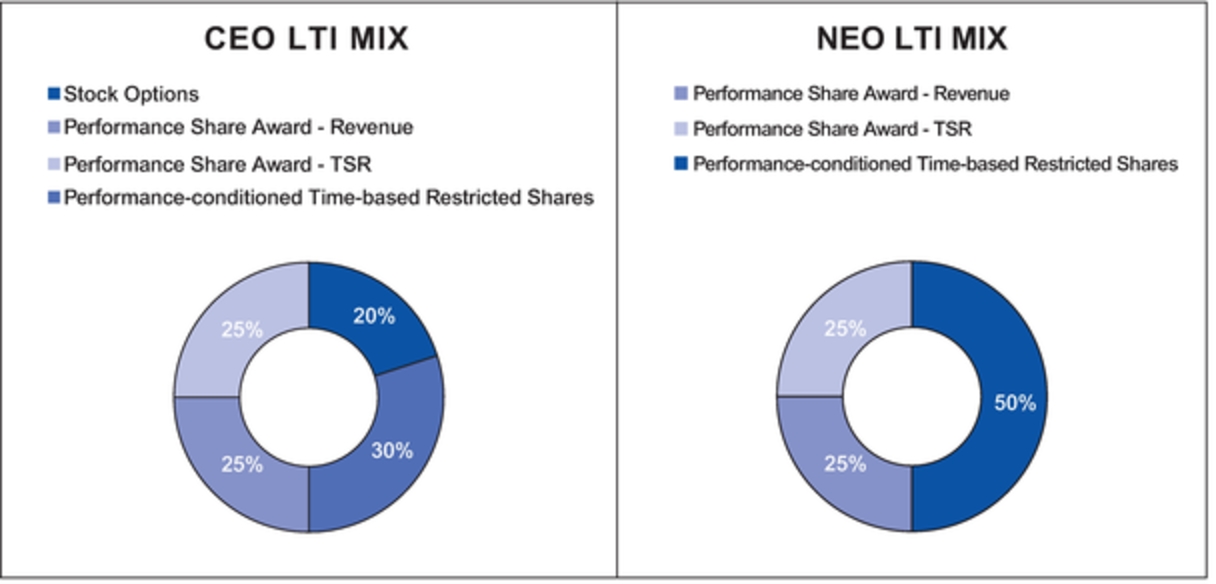

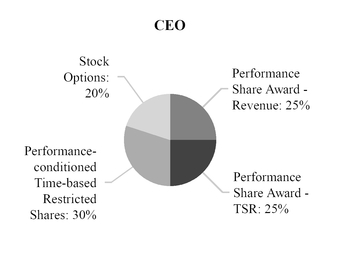

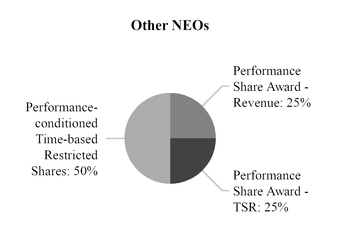

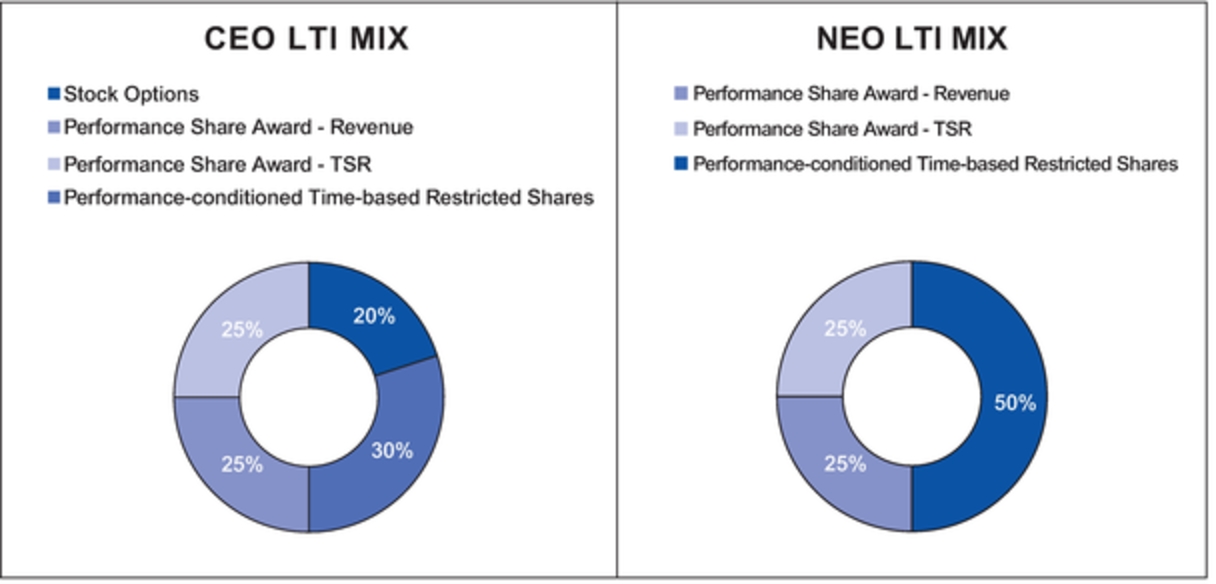

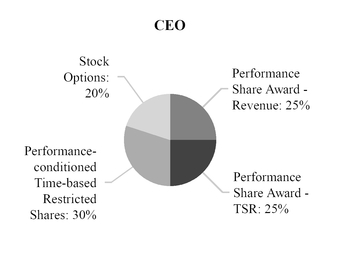

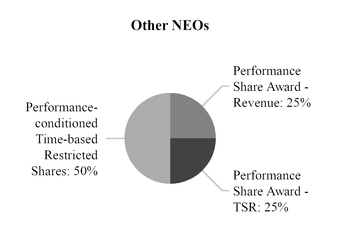

TABLE OF CONTENTS Best Buy 2020 Priorities: Relationship Net Promoter Score — 15% Domestic Cost Reduction – 15% Long-Term Incentive Awards of equity-based LTI compensation to our executive officers enhance the alignment of interests of our NEOs and shareholders. All LTI awards for our NEOs and directors must be approved by the Compensation Committee. In March 2018, the Compensation Committee approved long-term incentive awards to our NEOs pursuant to our fiscal 2019 LTI program under our Amended & Restated 2014 Omnibus Incentive Plan. The fiscal 2019 LTI program featured a mix of performance share awards, performance conditioned time-based restricted shares, and stock options. This results in a balanced portfolio of compensation rewards consisting of, for the CEO, 50 percent performance share awards based on relative total shareholder return (to reward relative performance) and enterprise revenue growth (to reward growth), 30 percent performance-conditioned time-based restricted shares, based on adjusted net earnings (to reward earnings and promote retention), and 20 percent stock options (to reward absolute share price appreciation), as shown below. The mix for the other NEOs was 50 percent performance share awards and 50 percent performance-conditioned time-based restricted shares, both with the same performance metrics as the CEO’s awards.

Form of Fiscal 2019 LTI Award. The NEOs receive an LTI grant once per year at a regularly scheduled Compensation Committee meeting that typically occurs in the first quarter of our fiscal year. In fiscal 2019, the closing price of our common stock on the grant date was used to convert the award dollar value to a number of units. In March 2018, the Compensation Committee approved the addition of dividend equivalents to restricted stock and performance share awards. These dividend equivalents begin to accrue for each declared dividend following the grant but are not converted into dividends until the restricted shares underlying the grants are earned, vested or payable. Determination of Fiscal 2019 LTI Target Award Values. The Compensation Committee approved the executive team’s fiscal 2019 compensation, which included increased target award values for Mr. Joly, Ms. Barry, Ms. Ballard, Mr. Mohan and Ms. Scarlett to reflect increased responsibilities, role changes and market adjustments. TABLE OF CONTENTS LTI award amounts are determined based upon analysis of external market data, with overall compensation mix and external market data for equivalent roles being key factors in the determination of the award made to each NEO. The fiscal 2019 LTI awards for each NEO are set forth below: Name | No. of Stock Options | No. of Performance-

Conditioned Time-

Based Restricted

Shares | Target No. of Shares

under Performance

Share Award(2) | Target Grant Date

Value | Mr. Joly | | 103,981 | | | 49,287 | | | 80,950 | | $ | 11,750,000 | | Ms. Barry | | — | | | 20,819 | | | 20,517 | | | 3,000,000 | | Mr. Mohan | | — | | | 24,636 | | | 24,278 | | | 3,550,000 | | Mr. Nelsen | | — | | | 11,451 | | | 11,285 | | | 1,650,000 | | Ms. Scarlett(1) | | 57,109 | | | 6,246 | | | 6,155 | | | 1,250,000 | | Ms. Ballard | | — | | | 24,636 | | | 24,278 | | | 3,550,000 | |

| (1) | Ms. Scarlett received her annual LTI grant in March 2018, before her promotion, plus a stock option grant with a 4-year cliff vesting in January 2019 in recognition of her increased responsibilities. The grant date value reflects her annual LTI target effective for fiscal 2020. |

| (2) | Performance Share Awards include shares for both the TSR and Revenue performance metrics, as described below. |

Performance Share Awards.The performance share awards are earned based on two metrics: half on total shareholder return (“TSR”) relative to the S&P 500 Index and the other half on enterprise revenue growth, both over a three-year period. TSR was selected as one of the metrics based on its direct link to shareholder value creation. The S&P 500 was used as a proxy for the broad variety of other investment opportunities available to investors. The relative TSR performance goals were as follows: | Relative TSR Percentile Ranking | No. of Shares Earned

(as % of Target) | Less than Threshold | Less than 30th Percentile | —% | Threshold | 30th Percentile | 50% | Target | 50th Percentile | 100% | Maximum | 70th Percentile | 150% |

The number of performance shares earned are interpolated on a linear basis for performance between Threshold and Target and between Target and Maximum. The other half of the performance share awards are earned based on the compound annual growth rate of enterprise revenue over the three fiscal years ending on the end of fiscal 2021. The Compensation Committee chose this metric in fiscal 2017 to sharpen our focus on profitable growth and to further align our performance metrics with our Best Buy 2020 growth strategy. The Committee believes this metric is an effective measurement of Company performance, particularly when combined with our TSR based awards. Although the Committee has not specifically assessed the probability of achieving any performance metric, based on the Company’s historical results and its assessment of the Company’s strategy, it believes achieving target performance under this award is reasonably attainable while providing appropriately challenging incentives, and that achieving maximum performance would be difficult. Shares will be earned under this metric as follows: | No. of Shares Earned (as % of Target) | Less than Threshold | —% | Threshold to Target | 50% to 100% | Target to Maximum | 100% to 150% | Above Maximum | 150% |

The final number of performance shares earned are interpolated on a linear basis for performance between Threshold and Target and between Target and Maximum. Performance-conditioned Time-based Restricted Share Awards. The performance-conditioned time-based restricted shares also vest in equal installments of one-third on the three successive anniversaries of the grant date, provided the performance condition has been met in any fiscal year during the term of the award. The performance condition was added to the time-based restricted shares to further align compensation with shareholder interests. The vesting of these shares is conditioned upon the Company’s achievement of positive Adjusted Net Earnings. Adjusted Net Earnings means net earnings determined in accordance with GAAP, adjusted to eliminate the following: (1) the TABLE OF CONTENTS cumulative effect of changes in GAAP; (2) gains and losses from discontinued operations; (3) extraordinary gains and losses; and (4) other unusual or nonrecurring gains or losses which are separately identified and quantified, including merger-related charges. Achievement of positive Adjusted Net Earnings may occur in any fiscal year during the term of the award for the award to begin to vest. For example, if the performance condition is not achieved until year two, two-thirds of the award will vest following Compensation Committee approval of achievement of the performance condition, with the remaining one-third to vest in the third year of the award. Stock Options. The non-qualified stock options granted to Mr. Joly and Ms. Scarlett have a term of ten years and become exercisable over either a three-year period at the rate of one-third per year, beginning one year from the grant date or become fully vested after a four-year period, subject to being employed on the vesting date. The exercise price for such options is equal to the closing price of our common stock on the grant date, as quoted on the NYSE. Under the terms of the Amended and Restated 2014 Omnibus Incentive Plan, we may not grant stock options with a strike price at a discount to fair market value. Unless otherwise determined by the Compensation Committee, “fair market value” as of a given date is the closing price of our common stock as quoted on the NYSE on such date or, if the shares were not traded on that date, the most recent preceding date when the shares were traded. Performance Share Payout. In March 2015, the Compensation Committee adopted a performance share plan design, based on relative TSR versus the S&P 500 Index over the 36-month period from March 1, 2015 to February 28, 2018. The shares vested (0 to 150%) after the three-year period if the performance criteria was met. Because the Company’s TSR during the performance period exceeded the 70th percentile of all companies in the S&P 500, these shares paid out at the maximum of 150 percent in fiscal 2019 and are reflected in the Compensation of Executive Officers — Option Exercises and Stock Vested section. Canadian Special Award. In January 2016, the Compensation Committee approved a special cash-based long-term incentive plan for the Best Buy Canada executive team which was tied to the profitability of our Canadian business, specifically the level of Canadian operating income achieved during fiscal 2019. Prior to becoming the Company’s Chief Human Resources Officer in June 2017, Ms. Scarlett was the Senior Vice President of Retail and Chief Human Resources Officer for Best Buy Canada and was, therefore, eligible for a prorated payout under this award for her time in that role. Ms. Scarlett’s payout under this award is reflected in the Compensation of Executive Officers — Summary Compensation Table section. Preview - Fiscal 2020 LTI Program Design. For fiscal 2020, the Committee aligned the mix of equity vehicles for Ms. Barry, Ms. Scarlett and Mr. Mohan with Mr. Joly’s mix. Other Compensation Benefits. Our executive officers, including our NEOs, are generally offered the same employee benefits offered to all U.S.-based officers, except as summarized in the following table: Benefit | All Full-Time

U.S.-Based Employees | Executive

Officers | Accidental Death & Dismemberment | | • | | | • | | Deferred Compensation Plan(1) | | | | | • | | Employee Discount | | • | | | • | | Employee Stock Purchase Plan | | • | | | • | | Health Insurance | | • | | | • | | — Executive Physical Exam | | | | | • | | Life Insurance | | • | | | • | | Long-Term Disability | | • | | | • | | — Executive Long-Term Disability | | | | | • | | Retirement Savings Plan | | • | | | • | | Severance Plan | | • | | | • | | Short-Term Disability | | • | | | • | | Tax Planning and Preparation(2) | | | | | • | |

| (1) | Only officers and directors are eligible to participate in the Deferred Compensation Plan, as described in the Compensation of Executive Officers – Nonqualified Deferred Compensation – Deferred Compensation Plan section. |

| (2) | Only Senior Vice Presidents and above are eligible to receive the tax planning and preparation benefit. |

TABLE OF CONTENTS We provide the executive benefits noted above to compete for executive talent and to promote the health, well-being and financial security of our NEOs. A description of executive benefits, and the costs associated with providing them for the NEOs, are reflected in the “All Other Compensation” column of the Summary Compensation Table as found in the Compensation of Executive Officers section of this proxy statement. Private Jet Use Policy. In June 2018, the Audit Committee adopted a Private Jet Use Policy governing the use of private jet services by the CEO. Under the policy, only the CEO is allowed to request private jet services for business or personal travel. When requesting the jet for personal travel, the policy dictates that Mr. Joly pay the jet provider directly for those services. For flights that will be for both business and personal purposes, Mr. Joly is to reimburse the Company for any amounts that do not qualify as business expense, up to any limitations imposed by the Federal Aviation Administration. Severance Plan. We have a severance plan that complies with the applicable provisions of the Employee Retirement Income Security Act (“ERISA”). The purpose of the severance plan is to provide financial assistance to employees while they seek other employment, in exchange for a release of any claims. Although there are differences in benefits depending on the employee’s job level, the basic elements of the plan are comparable for all eligible employees. The plan generally covers all full-time and part-time U.S. employees of Best Buy Co., Inc. and Best Buy Stores, L.P. and their respective direct and indirect U.S.-domiciled subsidiaries, including the NEOs, except for those subject to a separate severance agreement or specifically excluded. The plan covers involuntary terminations due to job elimination and discontinuation, office closing, reduction in force, business restructuring and other circumstances as we determine. Eligible terminated employees receive a severance payment based on their role and time with the Company, with basic employee benefits such as medical, dental and life insurance continued for an equivalent period. Except as modified or replaced by individual employment agreements, the NEOs (other than Mr. Joly and Ms. Barry who currently have employment agreements) are eligible for the following severance benefits: Mses. Ballard and Scarlett and Messrs. Mohan and Nelsen, at an enterprise executive vice president level, are eligible for two years of salary, a payment of $25,000 in lieu of outplacement and other tax and financial planning assistance, and a payment of 150% of the cost of 24 months of basic employee benefits such as medical, dental and life insurance. See Compensation of Executive Officers - Potential Payments Upon Termination or Change-of-Control for more information regarding potential payments following an involuntary termination and for the severance provisions of Mr. Joly’s and Ms. Barry’s employment agreements. Upon her departure, Ms. Ballard did not receive any severance payments. Executive Stock Ownership Guidelines. The Compensation Committee has established stock ownership guidelines to promote the alignment of officer and shareholder interests and to encourage behaviors that have a positive influence on stock price appreciation and total shareholder return. Under the guidelines, we expect our NEOs to acquire ownership of a fixed number of shares, based on their positions. The stock ownership expectation generally remains effective for as long as the officer holds the position. In addition to shares personally owned by each officer, the following forms of stock ownership count toward the ownership target: Equivalent shares owned in the Best Buy Stock Fund within our Retirement Savings Plan; 100% of non-vested shares (net of taxes) subject to time-based conditions granted under our LTI program; and 50% of the intrinsic value of vested stock options (denominated as a number of shares) granted under our LTI program. We require that until the ownership target is met, NEOs will retain: (i) 50% of the net proceeds received from the exercise of a stock option in the form of Best Buy common stock; (ii) 50% of vested time-based restricted shares (net of taxes); and (iii) 50% of all performance share awards (net of taxes) issued. The ownership target does not need to be met within a certain time frame, and our NEOs are considered in compliance with the guidelines as long as progress towards the ownership target is being made consistent with the expectations noted above. TABLE OF CONTENTS In fiscal 2019, all NEOs were in compliance with the ownership guidelines. The ownership targets and ownership levels as of the end of fiscal 2019 for our continuing NEOs are shown below. Name | Ownership Target

(in shares) | Ownership as of Fiscal 2019

Year-End Using Guidelines

(in shares) | Mr. Joly | | 200,000 | | | 800,660 | | Ms. Barry | | 55,000 | | | 101,729 | | Mr. Mohan | | 55,000 | | | 99,340 | | Mr. Nelsen | | 35,000 | | | 80,522 | | Ms. Scarlett | | 35,000 | | | 23,538 | |

Tax Deductibility of Compensation. Until recently, Section 162(m) of the Internal Revenue Code (“Section 162(m)”) has limited the deductibility of compensation in excess of $1 million paid to the chief executive officer and each of our three most highly compensated executive officers (other than the chief financial officer), unless the compensation qualifies as “performance-based compensation.” The Tax Cuts and Jobs Act of 2017 amended Section 162(m) with respect to fiscal years beginning after December 31, 2017 to remove the performance-based compensation exception and expand the scope of Section 162(m) to apply to our chief financial officer and certain other NEOs, other than in the case of certain arrangements in place as of November 2, 2017, which qualify for transition relief. The Committee has historically attempted to structure its compensation arrangements to achieve deductibility under Section 162(m) of the Internal Revenue Code, unless the benefit of such deductibility was considered by the Committee to be outweighed by the need for flexibility or the attainment of other objectives. As was the case prior to the enactment of the Tax Cuts and Jobs Act, the Committee will continue to monitor issues concerning the deductibility of executive compensation. We do not, however, make compensation decisions based solely on the availability of a deduction under Section 162(m). Accordingly, we expect that at least a portion of the compensation paid to our NEOs in excess of $1 million per officer will be non-deductible. For purposes of Section 162(m), we created a sub-plan under our Amended & Restated 2014 Omnibus Incentive Plan for our fiscal year ended February 2, 2019. The sub-plan sets the maximum award pool for the CEO and five other NEOs (excluding the CFO) at 7 percent of adjusted net earnings to align compensation with shareholder interests. The maximum potential individual allocations from that pool were set at 2 percent for the CEO and 1 percent for each of the three other NEOs (excluding the CFO). The Committee then used negative discretion to reduce the amounts that were potentially payable under the sub-plan award pool to equal amounts based on achievement of STI plan metrics. Clawback and Restrictive Covenant Provisions. All STI and LTI awards granted to our NEOs are subject to our clawback policy. The triggers for potential recoupment of such awards include breach of the restrictive covenants in our long-term incentive award agreements, breach of our Code of Business Ethics, and issuance of a financial restatement as a result of fraud or misconduct. We also include confidentiality, non-compete, non-solicitation and, in select situations, non-disparagement provisions in our long-term incentive award agreements. Prohibition on Hedging and Pledging Company Securities. We prohibit all employees, including NEOs, and members of the Board from hedging Company securities, including by way of forward contracts, equity swaps, collars, exchange funds or otherwise. In addition, our executive officers and Board members are prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan. Compensation and Human Resources Committee Report on Executive Compensation The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended February 2, 2019, and in this proxy statement. COMPENSATION AND HUMAN RESOURCES COMMITTEE Russell P. Fradin (Chair)

Lisa M. Caputo

J. Patrick Doyle

Kathy J. Higgins Victor TABLE OF CONTENTS Compensation and Human Resources Committee Interlocks and Insider Participation The Compensation Committee is comprised entirely of independent directors. At no time during fiscal 2019 was any member of the Compensation Committee a current or former officer or employee of the Company or any of its subsidiaries. During fiscal 2019, no member of the Compensation Committee had a relationship that must be described pursuant to SEC disclosure rules on related party transactions. In fiscal 2019, none of our executive officers served on the board of directors or compensation committee of another company that had one or more executive officers serving on our Board or Compensation Committee. TABLE OF CONTENTS Compensation of Executive Officers Summary Compensation Table The table below summarizes the total compensation earned by each of our NEOs during fiscal 2019 and the two preceding fiscal years (if applicable). Name and Principal Position | Year | Salary(1) | Stock

Awards(2)(3) | Option

Awards(2) | Non-Equity

Incentive

Plan Compensation(4) | All Other

Compensation(5) | Total | Hubert Joly(7)

Chairman and Chief

Executive Officer | | 2019 | | $ | 1,275,000 | | $ | 9,391,513 | | $ | 2,267,826 | | $ | 4,240,650 | | $ | 207,497 | | $ | 17,382,486 | | | 2018 | | | 1,286,058 | | | 8,644,644 | | | 2,198,462 | | | 4,602,983 | | | 81,558 | (6) | | 16,813,704 | | | 2017 | | | 1,175,000 | | | 7,689,879 | | | 1,800,076 | | | 2,878,750 | | | 494,275 | | | 14,037,980 | | Corie S. Barry

Chief Financial Officer and Strategic

Transformation Officer | | 2019 | | | 834,615 | | | 2,997,563 | | | — | | | 2,078,750 | | | 8,752 | | | 5,919,680 | | | 2018 | | | 764,423 | | | 2,008,397 | | | — | | | 2,057,625 | | | 8,203 | | | 4,838,648 | | | 2017 | | | 713,462 | | | 1,689,495 | | | — | | | 1,184,167 | | | 14,893 | | | 3,602,017 | | R. Michael Mohan

Chief Operating Officer,

Best Buy U.S. | | 2019 | | | 892,308 | | | 3,547,097 | | | — | | | 2,224,262 | | | 30,098 | | | 6,693,765 | | | 2018 | | | 866,346 | | | 3,012,512 | | | — | | | 2,331,975 | | | 22,907 | | | 6,233,740 | | | 2017 | | | 833,654 | | | 2,895,073 | | | — | | | 1,531,251 | | | 55,284 | | | 5,315,262 | | Keith J. Nelsen(8)

General Counsel and

Secretary (Former) | | 2019 | | | 740,769 | | | 1,651,340 | | | — | | | 1,230,620 | | | 34,602 | | | 3,657,331 | | | 2018 | | | 697,885 | | | 1,656,905 | | | — | | | 1,249,817 | | | 22,507 | | | 3,627,114 | | | 2017 | | | 650,000 | | | 1,592,960 | | | — | | | 796,250 | | | 68,761 | | | 3,107,971 | | Kamy Scarlett

Chief Human Resources

Officer and President, U.S

Retail Stores | | 2019 | | | 684,615 | | | 899,283 | | | 1,009,116 | | | 1,444,451 | | | 165,029 | | | 4,202,494 | | Shari L. Ballard(9)

President, Multi-Channel

Retail (Former) | | 2019 | | | 892,308 | | | 3,547,097 | | | — | | | 2,224,262 | | | 41,430 | | | 6,705,097 | | | 2018 | | | 859,616 | | | 3,012,512 | | | — | | | 2,309,113 | | | 24,367 | | | 6,205,608 | | | 2017 | | | 800,000 | | | 1,930,865 | | | — | | | 1,470,000 | | | 62,737 | | | 4,263,602 | |

| (1) | These amounts reflect actual earnings based on a blend of prior annual base salary rates and the go-forward base salary rates approved by the Compensation Committee. InCommittee during its annual review in March 2017,of each year, as well as any off-cycle increases approved by the Compensation Committee approved long-term incentiveduring the year. Further, these amounts are before any deferrals under the Deferred Compensation Plan. We do not provide guaranteed, above-market or preferential earnings on compensation deferred under the Deferred Compensation Plan. The investment options available for notional investment of deferred compensation are similar to those available under the Retirement Savings Plan and can be found, along with additional information about deferred amounts, in the Nonqualified Deferred Compensation section. |

| (2) | These amounts reflect the aggregate grant date fair value for stock-based awards granted to our NEOs pursuantfor all fiscal years reflected; however, fiscal 2019 amounts are explained in greater detail under the heading Grants of Plan-Based Awards. The grant date fair value reflected for any award subject to performance conditions is the value at the grant date of the probable outcome of the award. The grant date fair value of an award is measured in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation - Stock Compensation (“ASC Topic 718”). The amounts reported have not been adjusted to eliminate service-based forfeiture assumptions. The other assumptions used in calculating these amounts are set forth in Note 7, Shareholders’ Equity, of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal 2018 LTI program under our 2014 Omnibus Incentive Plan.year ended February 2, 2019. |

TABLE OF CONTENTS | (3) | The fiscal 2018 LTI program featured2019 amounts reflected in this column include the probable grant date fair value of: (a) one or more restricted share awards that vest on a mixtime-based schedule subject to achievement of positive adjusted net earnings in any fiscal year during the three-year term of the award (described in greater detail in the Grants of Plan-Based Awards section), and (b) one or more performance share awards that will be earned depending on the performance conditioned time-based restricted shares, and stock options. This resultsof our stock’s total shareholder return, relative to the S&P 500 Index, over a three-year period or depending on the compound annual growth rate of our enterprise revenue over a three-year period (also described in a balanced portfoliogreater detail in the Grants of compensation rewards consistingPlan-Based Awards section). The maximum value of for the CEO, 50 percent performance share awards based on relative total shareholder return (to reward relative performance) and enterprise revenue growth (to reward growth), 30 percent performance-conditioned time-based restricted shares, based on adjusted net earnings (to reward earnings and promote retention), and 20 percent stock options (to reward absolute share price appreciation),for each NEO as shown below. The mix forof the other NEOs was 50 percentgrant date, assuming the highest level of performance, is noted in the following table: |

Name | Target

Performance

Grant

(in Shares) | Probable Grant

Date Fair Value

of Performance

Grant (as

reflected in Stock

Awards Column) | Maximum

Performance

Grant (in Shares) | Maximum Grant

Date Fair Value of

Performance Grant | Mr. Joly | | 80,950 | | $ | 5,866,507 | | | 121,425 | | $8,799,760 | Ms. Barry | | 20,517 | | | 1,497,554 | | | 30,776 | | 2,246,331 | Mr. Mohan | | 24,278 | | | 1,772,074 | | | 36,417 | | 2,658,110 | Mr. Nelsen | | 11,321 | | | 826,296 | | | 16,982 | | 1,239,444 | Ms. Scarlett | | 6,155 | | | 449,259 | | | 9,233 | | 673,888 | Ms. Ballard | | 24,278 | | | 1,772,074 | | | 36,417 | | 2,658,110 |

| * | Multiple performance share awards for each NEO have been aggregated in the table above. For additional detail, see the Grants of Plan-Based Awards section. |

| (4) | These amounts reflect STI payments made for all fiscal years shown, except for Ms. Scarlett’s fiscal 2019 amount which includes her fiscal 2019 STI payment ($1,153,706) as well as her Canadian special award payment ($290,745*). The fiscal 2019 STI plan is described in the section Compensation Discussion and 50 percent performance-conditioned time-based restricted shares, bothAnalysis – Executive Compensation Elements – Short-Term Incentive. The Canadian special award relative to Ms. Scarlett is described in the section Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive. |

| * | Ms. Scarlett’s Canadian special award payment is reflected in USD using a rate of 1.3095 CAD per USD, which was the USD:CAD exchange rate as determined by the Board of Governors of the Federal Reserve Bank of New York for February 1, 2019 (the last business day of fiscal 2019). |

| (5) | The fiscal 2019 amounts reflected in this column include All Other Compensation as described in the following table: |

Name | Retirement Plan

Contribution(a) | Life Insurance

Premiums(b) | Other | Total | Mr. Joly | $ | 11,000 | | $ | 492 | | $ | 196,005 | (c) | $ | 207,497 | | Ms. Barry | | 8,260 | | | 492 | | | — | (d) | | 8,752 | | Mr. Mohan | | 11,154 | | | 492 | | | 18,452 | (e) | | 30,098 | | Mr. Nelsen | | 10,077 | | | 492 | | | 24,033 | (f) | | 34,602 | | Ms. Scarlett | | 11,615 | | | 345 | | | 153,069 | (g) | | 165,029 | | Ms. Ballard | | 11,481 | | | 492 | | | 29,457 | (h) | | 41,430 | |

| (a) | These amounts reflect our matching contributions to the NEOs’ Retirement Savings Plan accounts. |

| (b) | These amounts reflect premiums paid by us for group term life insurance coverage. |

| (c) | The amount reflects premiums paid by us for supplemental executive long-term disability insurance ($63,215), the cost of an executive physical and the incremental cost of Mr. Joly’s use of private jet services for travel to outside board meetings ($129,763).

The Company considers travel to outside board meetings to be business-related as part of Mr. Joly’s professional development as determined by our Board, and therefore, Mr. Joly is not required to reimburse the Company for those flights. Nevertheless, the incremental cost to the Company of those flights is being reported here and includes the lease cost and other variable charges. |

| (d) | Any perquisites and other benefits provided to Ms. Barry for fiscal 2019 were less than $10,000 and information regarding any such perquisites or other personal benefits has therefore not been included. |

| (e) | The amount reflects premiums paid by us for supplemental executive long-term disability insurance ($16,512) and company-paid tax preparation and planning services ($1,940). |

| (f) | The amount reflects premiums paid by us for supplemental executive long-term disability insurance ($20,000) and the cost of an executive physical ($4,033). |

| (g) | The amount reflects premiums paid by us for supplemental executive long-term disability insurance and benefits provided as part of Ms. Scarlett’s relocation from Canada to the United States, including company-paid estate planning services, tax gross-ups on the estate planning services ($2,850), company-paid tax preparation and planning services ($47,377), tax gross-ups on the tax preparation and planning services ($39,713), tax equalization payments made on Ms. Scarlett’s behalf to cover incremental taxes ($26,263), tax gross-ups on the tax equalization payments ($22,015) and company-paid green card expenses. |

| (h) | The amount reflects premiums paid by us for supplemental executive long-term disability insurance. |

| (6) | Mr. Joly’s “All Other Compensation” total for fiscal 2018 has been amended to include the incremental cost of Mr. Joly’s use of private jet services for travel to outside board meetings in fiscal 2018 ($53,251), which had been inadvertently excluded. |

| (7) | On June 11, 2019, Mr. Joly will step down from his role as our CEO and transition to the role of Executive Chairman. |

TABLE OF CONTENTS | (8) | On April 12, 2019, Mr. Nelsen stepped down from his role as General Counsel and Secretary and transitioned into an advisory capacity with the same performance metricsCompany. |

| (9) | During fiscal 2019, Ms. Ballard stepped down from her role as President, Multi-Channel Retail and transitioned into an advisory capacity with the CEO’s awards.Company. |

Grants of Plan-Based Awards The table below summarizes the grants made to each of our NEOs during fiscal 2019 under the 2014 Omnibus Incentive Plan and the Short-Term Incentive Plan: Name | Grant Date | Estimated Future Payouts Under

Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under

Equity Incentive Plan Awards |

Option

Awards:

Number of

Securities

Underlying

Options

(#) | Form Exercise

or

Base Price

of Fiscal 2018 LTI Award. Option

Awards

($ / Sh)

| Grant Date

Fair Value

of Stock

and

Option

Awards

($)(2) | Threshold ($) | Target

($) | Maximum ($) | Threshold (#) | Target

(#) | Maximum

(#) |

Mr. Joly(3) | | — | | $ | 510,000 | | $ | 2,550,000 | | $ | 5,100,000 | | | — | | | — | | | — | | | — | | $ | — | | $ | — | | | 3/12/2018 | (4) | | — | | | — | | | — | | | — | | | — | | | — | | | 103,981 | | | 71.52 | | | 2,267,826 | | | 3/12/2018 | (5) | | — | | | — | | | — | | | — | | | 49,287 | | | 49,287 | | | — | | | — | | | 3,525,006 | | | 3/12/2018 | (6) | | — | | | — | | | — | | | 19,939 | | | 39,877 | | | 59,816 | | | — | | | — | | | 2,928,966 | | | 3/12/2018 | (7) | | — | | | — | | | — | | | 20,537 | | | 41,073 | | | 61,610 | | | — | | | — | | | 2,937,541 | | Ms. Barry | | — | | | 250,000 | | | 1,250,000 | | | 2,500,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3/12/2018 | (8) | | — | | | — | | | — | | | — | | | 20,819 | | | 20,819 | | | — | | | — | | | 1,500,009 | | | 3/12/2018 | (6) | | — | | | — | | | — | | | 5,054 | | | 10,107 | | | 15,161 | | | — | | | — | | | 747,514 | | | 3/12/2018 | (7) | | — | | | — | | | — | | | 5,205 | | | 10,410 | | | 15,615 | | | — | | | — | | | 750,041 | | Mr. Mohan | | — | | | 267,000 | | | 1,337,500 | | | 2,675,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3/12/2018 | (8) | | — | | | — | | | — | | | — | | | 24,636 | | | 24,636 | | | — | | | — | | | 1,775,024 | | | 3/12/2018 | (6) | | — | | | — | | | — | | | 5,980 | | | 11,960 | | | 17,940 | | | — | | | — | | | 884,562 | | | 3/12/2018 | (7) | | — | | | — | | | — | | | 6,159 | | | 12,318 | | | 18,477 | | | — | | | — | | | 887,512 | | Mr. Nelsen | | — | | | 148,000 | | | 740,000 | | | 1,480,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3/12/2018 | (8) | | — | | | — | | | — | | | — | | | 11,451 | | | 11,451 | | | — | | | — | | | 825,045 | | | 3/12/2018 | (6) | | — | | | — | | | — | | | 2,780 | | | 5,559 | | | 8,339 | | | — | | | — | | | 411,144 | | | 3/12/2018 | (7) | | — | | | — | | | — | | | 2,881 | | | 5,762 | | | 8,643 | | | — | | | — | | | 415,152 | | Ms. Scarlett | | — | | | 138,750 | | | 693,750 | | | 1,387,500 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3/12/2018 | (8) | | — | | | — | | | — | | | — | | | 6,246 | | | 6,246 | | | — | | | — | | | 450,024 | | | 3/12/2018 | (6) | | — | | | — | | | — | | | 1,516 | | | 3,032 | | | 4,548 | | | — | | | — | | | 224,247 | | | 3/12/2018 | (7) | | — | | | — | | | — | | | 1,562 | | | 3,123 | | | 4,685 | | | — | | | — | | | 225,012 | | | 1/24/2019 | (9) | | — | | | — | | | — | | | — | | | — | | | — | | | 57,109 | | | 57.60 | | | 1,009,116 | | Ms. Ballard | | — | | | 267,500 | | | 1,337,500 | | | 2,675,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3/12/2018 | (8) | | — | | | — | | | — | | | — | | | 24,636 | | | 24,636 | | | — | | | — | | | 1,775,024 | | | 3/12/2018 | (6) | | — | | | — | | | — | | | 5,980 | | | 11,960 | | | 17,940 | | | — | | | — | | | 884,562 | | | 3/12/2018 | (7) | | — | | | — | | | — | | | 6,159 | | | 12,318 | | | 18,477 | | | — | | | — | | | 887,512 | |

| (1) | These amounts reflect the potential threshold, target and maximum payout for each NEO under our fiscal 2019 STI, which is described in greater detail under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Short-Term Incentive. The NEOs receive an LTI grant once per year at a regularly scheduled Compensation Committee meeting that typically occursactual payout to each NEO for fiscal 2019 is provided in the first quarterfollowing sections: Compensation Discussion and Analysis – Executive Compensation Elements – Short-Term Incentive and the Summary Compensation Table. |

| (2) | These amounts reflect the aggregate grant date fair value, measured in accordance with ASC Topic 718. The amounts reported have not been adjusted to eliminate service-based forfeiture assumptions. The other assumptions used in calculating these amounts are set forth in Note 7, Shareholders’ Equity, of the Notes to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended February 2, 2019. The value reflected for any performance-conditioned award is the value at the grant date based upon the probable outcome of the award – see footnote (3) to the Summary Compensation Table. |

| (3) | Mr. Joly will meet the age and service conditions for qualified retirement, as defined in our award agreements, in August 2019, prior to the second scheduled vesting of his fiscal 2019 time-based awards and prior to the end of the performance period for his fiscal 2019 performance share awards. The effect of qualified retirement on all of our fiscal year. In fiscal 2018,outstanding equity awards is discussed in the Potential Payments Upon Termination or Change-of-Control section. |

| (4) | The amounts reflect nonqualified stock options, as discussed under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive, that have a term of ten years and become exercisable in three equal installments of one-third on each of the first three anniversaries of the grant date provided the NEO has been continually employed with us through those dates. The option exercise price is equal to the closing price of our common stock on the grant date, was used to convertas quoted on the award dollar value to a numberNYSE. |

| (5) | The amounts reflect performance-conditioned time-based restricted stock units, as discussed under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive, which will vest in three equal installments of units.one-third on each of |

Performance Share Awards.TABLE OF CONTENTS the first three anniversaries of the grant date, provided the NEO has been continually employed with us through those dates and provided that we have achieved positive “adjusted net earnings” as of the end of any fiscal year during the three-year term of the award. The NEO is also entitled to an accrual of dividend equivalents, equal to the cash amount that would have been payable on the number of restricted stock units held by them as of the close of business on the record date for each declared divided, which shall be credited to them as the equivalent amount of shares that could have been purchased as of the close of business on the dividend payment date. The accrued dividend equivalents will be payable when the restricted stock units on which such dividend equivalents were credited have become earned, vested and payable. | (6) | The amounts reflect performance share awards, areas discussed under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive, that, if earned, basedwill vest at or between the threshold (50% of target) and maximum (150% of target) levels depending on two metrics: half onthe performance of our stock’s total shareholder return, (“TSR”) relative to the S&P 500 Index, over the 36-month period commencing on February 4, 2018, and ending on January 30, 2021. The NEO is also entitled to an accrual of dividend equivalents, equal to the other halfcash amount that would have been payable on enterprise revenue growth, both over a three-year period. TSR was selectedthe number of performance shares held by them as one of the metrics basedclose of business on its direct linkthe record date for each declared divided, which shall be credited to shareholder value creation.them as the equivalent amount of shares that could have been purchased as of the close of business on the dividend payment date. The S&P 500 was used as a proxy for other investment opportunities available to investors. accrued dividend equivalents will be payable when the performance shares on which such dividend equivalents were credited have become earned, vested and payable. |

| (7) | The relative TSR performance goals were as follows: | | | | | Relative TSR Percentile Ranking | No. of Shares Earned (as % of Target) | Less than Threshold | Less than 30th Percentile | —% | Threshold | 30th Percentile | 50% | Target | 50th Percentile | 100% | Maximum | 70th Percentile | 150% | The number of performance shares earned are interpolated on a linear basis for performance between Threshold and Target and between Target and Maximum. |

The other half of theamounts reflect performance share awards, areas discussed under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive, that, if earned, basedwill vest at or between the threshold (50% of target) and maximum (150% of target) levels depending on the compound annual growth rate of our enterprise revenue, over the three fiscal years36-month period commencing on February 4, 2018, and ending on January 30, 2021. The NEO is also entitled to an accrual of dividend equivalents, equal to the end of fiscal 2020. The Compensation Committee chose this new metric last year to sharpen our focus on profitable growth and to further align our performance metrics with our Best Buy 2020 growth strategy. The Committee believes this metric will be an effective measurement of Company performance, particularly when combined with our TSR based awards. Although the Committee has not specifically assessed the probability of achieving any performance metric, basedcash amount that would have been payable on the Company’s historical results and its assessment of the Company’s strategy, it believes achieving target performance under this award is reasonably attainable while providing appropriately challenging incentives, and that achieving maximum performance would be difficult. Shares will be earned under this metric as follows:

| | | | No. of Shares Earned (as % of Target) | Less than Threshold | —% | Threshold to Target | 50% to 100% | Target to Maximum | 100% to 150% | Above Maximum | 150% |

The final number of performance shares held by them as of the close of business on the record date for each declared divided, which shall be credited to them as the equivalent amount of shares that could have been purchased as of the close of business on the dividend payment date. The accrued dividend equivalents will be payable when the performance shares on which such dividend equivalents were credited have become earned, are interpolated on a linear basis for performance between Thresholdvested and Target and between Target and Maximum.payable.

|

Performance-conditioned Time-based Restricted Stock Awards. | (8) | The amounts reflect performance-conditioned time-based restricted shares, alsoas discussed under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive, which will vest in three equal installments of one-third on each of the first three successive anniversaries of the grant date, provided the performance

conditionNEO has been met incontinually employed with us through those dates and provided that we have achieved positive “adjusted net earnings” as of the end of any fiscal year during the three-year term of the award. The performance condition was addedNEO is also entitled to an accrual of dividend equivalents, equal to the time-basedcash amount that would have been payable on the number of restricted shares to further align compensation with shareholder interests. The vesting of these shares is conditioned upon the Company's achievement of positive Adjusted Net Earnings. Adjusted Net Earnings means net earnings determined in accordance with GAAP, adjusted to eliminate the following: (1) the cumulative effect of changes in GAAP; (2) gains and losses from discontinued operations; (3) extraordinary gains and losses; and (4) other unusual or nonrecurring gains or losses which are separately identified and quantified, including merger-related charges. Achievement of positive Adjusted Net Earnings may occur in any fiscal year during the termheld by them as of the awardclose of business on the record date for each declared divided, which shall be credited to them as the award to begin to vest. For example, if the performance condition is not achieved until year two, two-thirdsequivalent amount of shares that could have been purchased as of the awardclose of business on the dividend payment date. The accrued dividend equivalents will vest following Compensation Committee approval of achievement ofbe payable when the performance condition, with the remaining one-third to vest in the third year of the award.restricted shares on which such dividend equivalents were credited have become earned, vested and payable.

|

Stock Options. | (9) | The non-qualifiedamounts reflect nonqualified stock options, granted to Mr. Jolyas discussed under the heading Compensation Discussion and Analysis – Executive Compensation Elements – Long-Term Incentive, that have a term of ten years and become exercisable on the fourth anniversary of the grant date, provided the NEO has been continually employed with us through that date. The option exercise price is equal to the closing price of our common stock on the grant date, as quoted on the NYSE. |

TABLE OF CONTENTS Outstanding Equity Awards at Fiscal Year-End The following table provides a summary of the NEO’s equity-based awards outstanding as of the end of fiscal 2019: | | Option Awards | Stock Awards | Name | Grant

Date(1) | Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#) | Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#) | Option

Exercise

Price

($) | Option

Expiration

Date | Number of

Shares or

Units of

Stock That

Have Not Vested

(#) | Market

Value of

Shares or

Units of

Stock That

Have Not Vested

($)(2) | Equity Incentive

Plan Awards:

Number of Unearned

Shares, Units or

Other Rights That

Have Not Vested

(#) | Equity Incentive

Plan Awards:

Market or Payout

Value of Unearned

Shares, Units or

Other Rights That

Have Not Vested

($)(2) | Mr. Joly(3) | | 3/13/2018 | | | | | | 103,981 | (4) | $ | 71.52 | | | 3/12/2028 | | | 50,644 | (5) | $ | 2,961,155 | | | 21,037 | (6) | $ | 1,230,004 | | | 3/13/2018 | | | | | | | | | | | | | | | | | | | | | 62,742 | (7) | | 3,668,496 | | | 3/13/2017 | | | 58,532 | | | 117,064 | (4) | | 44.85 | | | 3/12/2027 | | | 50,889 | (8) | | 2,975,480 | | | 97,277 | (9) | | 5,687,757 | | | 3/13/2017 | | | | | | | | | | | | | | | | | | | | | 98,342 | (10) | | 5,750,028 | | | 3/15/2016 | | | 149,260 | | | 74,630 | (4) | | 31.79 | | | 3/14/2026 | | | 33,113 | (11) | | 1,936,117 | | | 234,984 | (12) | | 13,739,514 | | | 3/12/2015 | | | 158,445 | | | | | | 40.85 | | | 3/11/2025 | | | | | | | | | | | | | | | 8/18/2014 | | | 183,990 | | | | | | 29.91 | | | 8/17/2024 | | | | | | | | | | | | | | | 4/16/2013 | | | 250,358 | | | | | | 23.66 | | | 4/15/2023 | | | | | | | | | | | | | | | 9/4/2012 | | | 350,468 | | | | | | 18.02 | | | 9/3/2022 | | | | | | | | | | | | | | Ms. Barry | | 3/12/2018 | | | | | | | | | | | | | | | 21,393 | (13) | | 1,250,849 | | | 5,334 | (14) | | 311,850 | | | 3/12/2018 | | | | | | | | | | | | | | | | | | | | | 15,903 | (15) | | 929,848 | | | 3/13/2017 | | | | | | | | | | | | | | | 15,780 | (16) | | 922,657 | | | 18,099 | (9) | | 1,058,249 | | | 3/13/2017 | | | | | | | | | | | | | | | | | | | | | 18,297 | (10) | | 1,069,826 | | | 3/15/2016 | | | | | | | | | | | | | | | 9,658 | (11) | | 564,703 | | | 41,123 | (12) | | 2,404,433 | | | 10/1/2015 | | | 33,253 | | | | | | 37.16 | | | 9/30/2025 | | | | | | | | | | | | | | | 3/12/2015 | | | 12,293 | | | | | | 40.85 | | | 3/11/2025 | | | | | | | | | | | | | | | 8/18/2014 | | | 14,730 | | | | | | 29.91 | | | 8/17/2024 | | | | | | | | | | | | | | | 6/19/2013 | | | 3,246 | | | | | | 27.66 | | | 6/18/2023 | | | | | | | | | | | | | | | 4/16/2013 | | | 3,243 | | | | | | 23.66 | | | 4/15/2023 | | | | | | | | | | | | | | | 1/21/2011 | | | 2,125 | | | | | | 35.67 | | | 1/12/2021 | | | | | | | | | | | | | | | 9/20/2010 | | | 2,125 | | | | | | 38.32 | | | 9/20/2020 | | | | | | | | | | | | | | | 6/23/2010 | | | 463 | | | | | | 36.63 | | | 6/23/2020 | | | | | | | | | | | | | | | 4/7/2010 | | | 523 | | | | | | 44.20 | | | 4/7/2020 | | | | | | | | | | | | | | | 1/13/2010 | | | 523 | | | | | | 39.73 | | | 1/13/2020 | | | | | | | | | | | | | | | 9/17/2009 | | | 523 | | | | | | 37.59 | | | 9/17/2019 | | | | | | | | | | | | | | Mr. Mohan | | 3/12/2018 | | | | | | | | | | | | | | | 25,316 | (17) | | 1,480,227 | | | 6,311 | (18) | | 369,004 | | | 3/12/2018 | | | | | | | | | | | | | | | | | | | | | 18,817 | (19) | | 1,100,230 | | | 3/13/2017 | | | | | | | | | | | | | | | 23,670 | (16) | | 1,383,985 | | | 27,147 | (9) | | 1,587,285 | | | 3/13/2017 | | | | | | | | | | | | | | | | | | | | | 27,444 | (10) | | 1,604,651 | | | 5/24/2016 | | | | | | | | | | | | | | | 5,743 | (11) | | 335,793 | | | 24,453 | (12) | | 1,429,767 | | | 3/15/2016 | | | | | | | | | | | | | | | 11,038 | (11) | | 645,392 | | | 46,998 | (12) | | 2,747,973 | | Mr. Nelsen | | 3/12/2018 | | | | | | | | | | | | | | | 11,769 | (20) | | 688,133 | | | 2,936 | (21) | | 171,639 | | | 3/12/2018 | | | | | | | | | | | | | | | | | | | | | 8,749 | (22) | | 511,554 | | | 3/13/2017 | | | | | | | | | | | | | | | 13,018 | (16) | | 761,162 | | | 14,931 | (9) | | 873,016 | | | 3/13/2017 | | | | | | | | | | | | | | | | | | | | | 15,095 | (10) | | 882,575 | | | 3/15/2016 | | | | | | | | | | | | | | | 9,106 | (11) | | 532,428 | | | 38,774 | (12) | | 2,267,087 | | Ms. Scarlett | | 1/24/2019 | | | | | | 57,109 | (23) | | 57.60 | | | 1/23/2029 | | | | | | | | | | | | | | | 3/12/2018 | | | | | | | | | | | | | | | 6,420 | (24) | | 375,377 | | | 1,602 | (25) | | 93,669 | | | 3/12/2018 | | | | | | | | | | | | | | | | | | | | | 4,773 | (26) | | 279,048 | | | 6/1/2017 | | | | | | | | | | | | | | | 5,481 | (16) | | 320,474 | | | 6,288 | (9) | | 367,659 | | | 6/1/2017 | | | | | | | | | | | | | | | | | | | | | 6,357 | (10) | | 371,694 | | | 3/13/2017 | | | | | | | | | | | | | | | 4,546 | (27) | | 265,805 | | | 5,214 | (10) | | 304,863 | | | 3/14/2016 | | | | | | | | | | | | | | | 3,420 | (27) | | 199,967 | | | 7,280 | (12) | | 425,632 | | | 3/12/2015 | | | 4,098 | | | | | | 40.85 | | | 3/11/2025 | | | | | | | | | | | | | | Ms. Ballard | | 3/12/2018 | | | | | | | | | | | | | | | 25,316 | (17) | | 1,480,227 | | | 6,311 | (18) | | 369,004 | | | 3/12/2018 | | | | | | | | | | | | | | | | | | | | | 18,817 | (19) | | 1,100,230 | | | 3/13/2017 | | | | | | | | | | | | | | | 23,670 | (16) | | 1,383,985 | | | 27,147 | (9) | | 1,587,285 | | | 3/13/2017 | | | | | | | | | | | | | | | | | | | | | 27,444 | (10) | | 1,604,651 | | | 3/15/2016 | | | | | | | | | | | | | | | 11,038 | (11) | | 645,392 | | | 46,998 | (12) | | 2,747,973 | |

| (1) | For a better understanding of the equity-based awards included in this table, we have provided the grant date of each award. |

TABLE OF CONTENTS | (2) | These amounts were determined based on the closing price of Best Buy common stock on the NYSE of $58.47 on February 1, 2019, the last trading day in fiscal 2019. |

| (3) | Mr. Joly will meet the age and service conditions for qualified retirement, as defined in our award agreements, in August 2019, which is during the term of his fiscal 2018 and fiscal 2019 time-based awards and prior to the end of the performance period for his fiscal 2018 and fiscal 2019 performance share awards (see awards with March 13, 2017, and March 13, 2018, grant dates). The effect of qualified retirement on all of our outstanding equity awards is discussed in the Potential Payments Upon Termination or Change-of-Control section. |

| (4) | The amount reflects nonqualified stock options that become exercisable over a three-year period at the rate of one-third per year, beginning one year from the grant date, subject to beingprovided Mr. Joly has been continually employed onwith us through those dates. |

| (5) | The amount reflects performance-conditioned time-based restricted stock units (49,287 restricted stock units remaining from the vesting date. The exercise price for such options is equal tooriginal grant and 1,357 restricted stock units accrued as dividend equivalents) that vest over a three-year period at the closing pricerate of our common stock onone-third per year, beginning one year from the grant date, provided Mr. Joly has been continually employed with us through those dates and provided that we have achieved positive “adjusted net earnings” as quoted on the NYSE. Under the terms of the 2014 Omnibus Plan, we may not grant stock options with a strike price at a discount to fair market value. Unless otherwise determined byend of any fiscal year during the Compensation Committee, "fair market value" as of a given date is the closing price of our common stock as quoted on the NYSE on such date or, if the shares were not traded on that date, the most recent preceding date when the shares were traded.

Determination of Fiscal 2018 LTI Target Award Values. The Compensation Committee approved the executive team’s fiscal 2018 compensation, which included increased target award values for Mr. Joly, Ms. Barry and Ms. Ballard to reflect increased responsibilities, role changes and market adjustments.

LTI award amounts are determined based upon analysis of external market data, with overall compensation mix and external market data for equivalent roles being key factors in the determinationthree-year term of the award made to each NEO.(the “Performance Condition”). The Performance Condition was achieved as of the end of fiscal 2018 LTI awards for each NEO are set forth below:

2019. |

| | | | | | | | | | | Annual Fiscal 2018 Award Details | | Name | | No. of Stock Options | | No. of Performance-Conditioned Time-Based Restricted Shares | | Target No. of Shares under Performance Share Award | | Target Grant Date Value | | Mr. Joly | | 175,596 | | 76,331 | | 130,412 | | $10,750,000 | | Ms. Barry | | — | | 23,670 | | 24,264 | | 2,000,000 | | Ms. Ballard | | — | | 35,505 | | 36,394 | | 3,000,000 | | Mr. Mohan | | — | | 35,505 | | 36,394 | | 3,000,000 | | Mr. Nelsen | | — | | 19,528 | | 20,017 | | 1,650,000 |

Performance Share Payout. In March 2014, the Compensation Committee adopted a | (6) | The amount reflects an outstanding performance share plan design,award assuming a threshold payout (50% of the target grant, or 19,938 shares) plus accrued dividend equivalents as of fiscal year-end (1,098 shares). The number of shares ultimately earned will be based on the performance of our stock’s total shareholder return, relative TSR versusto the S&P 500 Index, over the 36-month period from August 1, 2014 to July 31, 2017. Thecommencing on February 4, 2018, and ending on January 30, 2021. As of the end of fiscal 2019, performance was below the threshold payout level for these shares. Dividend equivalent shares would vest (0 to 150%) afteraccrue assuming a target payout and are adjusted and issued at the three-year period if the performance criteria was met. Because the Company’s TSR duringend of the performance period exceededbased on actual performance. |

| (7) | The amount reflects an outstanding performance share award assuming a maximum payout (150% of the 70th percentiletarget grant, or 61,610 shares) plus accrued dividend equivalents as of all companies infiscal year-end (1,132 shares). The number of shares ultimately earned will be based on the S&P 500, these shares paid outcompound annual growth rate of our enterprise revenue, over the 36-month period commencing on February 4, 2018, and ending on January 30, 2021. As of the end of fiscal 2019, performance was at the maximum of 150 percent in fiscal 2018payout level for these shares. Dividend equivalent shares accrue assuming a target payout and are reflected inadjusted and issued at the Compensation of Executive Officers - Option Exercises and Stock Vested section.

Fiscal 2019 LTI Program Design. For fiscal 2019, the mix of equity vehicles in the LTI program will be consistent with fiscal 2018.

Benefits. Our executive officers, including our NEOs, are generally offered the same employee benefits offered to all U.S.-based officers, as summarized in the following table:

| | | | | | Benefit | | All Full-Time

U.S.-Based Employees

| | Executive

Officers

| Accidental Death & Dismemberment | | ● | | ● | Deferred Compensation Plan(1)

| | | | ● | Employee Discount | | ● | | ● | Employee Stock Purchase Plan | | ● | | ● | Health Insurance | | ● | | ● | — Executive Physical Exam | | | | ● | Life Insurance | | ● | | ● | Long-Term Disability | | ● | | ● | — Executive Long-Term Disability | | | | ● | Retirement Savings Plan | | ● | | ● | Severance Plan | | ● | | ● | Short-Term Disability | | ● | | ● | Tax Planning and Preparation(2)

| | | | ● |

| | (1) | Only officers and directors are eligible to participate in the Deferred Compensation Plan, as described in the Compensation of Executive Officers – Nonqualified Deferred Compensation – Deferred Compensation Plan section.

|

| | (2) | Only Senior Vice Presidents and above are eligible to receive the tax planning and preparation benefit. |

We provide the executive benefits noted above to compete for executive talent and to promote the health, well-being and financial security of our NEOs. A description of executive benefits, and the costs associated with providing them for the NEOs, are reflected in the "All Other Compensation" columnend of the Summary Compensation Table as found in the Compensation of Executive Officers section of this proxy statement.

Severance Plan. We have a severance plan that complies with the applicable provisions of the Employee Retirement Income Security Act ("ERISA"). The purpose of the severance plan is to provide financial assistance to employees while they seek other employment, in exchange for a release of any claims. Although there are differences in benefits depending on the employee's job level, the basic elements of the plan are comparable for all eligible employees. The plan generally covers all full-time and part-time U.S. employees of Best Buy Co., Inc. and Best Buy Stores, L.P. and their respective direct and indirect U.S.-domiciled subsidiaries, including the NEOs, except for those subject to a separate severance agreement or specifically excluded.

The plan covers involuntary terminations due to job elimination and discontinuation, office closing, reduction in force, business restructuring and other circumstances as we determine. Eligible terminated employees receive a severance paymentperformance period based on their role and time withactual performance.

|

| (8) | The amount reflects performance-conditioned time-based restricted stock units that vest over a three-year period at the Company, with basic employee benefits such as medical, dental and life insurance continued for an equivalent period. Except as modified or replaced by individual employment agreements,rate of one-third per year, beginning one year from the NEOs (other thangrant date, provided Mr. Joly who has an employment agreement) are eligible forbeen continually employed with us through those dates and provided that we have achieved the following severance benefits: Mses. Ballard and Barry and Messrs. Mohan and Nelsen, at an enterprise executive vice president level, are eligible for two years of salary, a payment of $25,000 in lieu of outplacement and other tax and financial planning assistance, and a payment of 150% of the cost of 24 months of basic employee benefits such as medical, dental and life insurance.See Compensation of Executive Officers - Potential Payments Upon Termination or Change-of-Control for more information regarding potential payments following an involuntary termination and for the severance provisions of Mr. Joly's employment agreement.

Executive Stock Ownership Guidelines. Performance Condition. The Compensation Committee has established stock ownership guidelines to promote the alignment of officer and shareholder interests and to encourage behaviors that have a positive influence on stock price appreciation and total shareholder return. Under the guidelines, we expect our NEOs to acquire ownership of a fixed number of shares, based on their positions. The stock ownership expectation generally remains effective for as long as the officer holds the position.

In addition to shares personally owned by each officer, the following forms of stock ownership count toward the ownership target:

Equivalent shares owned in the Best Buy Stock Fund within our Retirement Savings Plan;

100% of non-vested shares subject to time-based conditions granted under our LTI program; and

50% of the intrinsic value of vested stock options (denominated as a number of shares) granted under our LTI program.

We require that until the ownership target is met, NEOs will retain: (i) 50% of the net proceeds received from the exercise of a stock option in the form of Best Buy common stock; (ii) 50% of vested time-based restricted shares (net of taxes); and (iii) 50% of all performance share awards (net of taxes) issued. The ownership target does not need to be met within a certain time frame, and our NEOs are considered in compliance with the guidelines as long as progress towards the ownership target is being made consistent with the expectations noted above.

In fiscal 2018, all NEOs were in compliance with the ownership guidelines. The ownership targets and ownership levelsPerformance Condition was achieved as of the end of fiscal 2018 for our NEOs are shown below.

2018. |

| | | | | | | Name | | Ownership Target (in shares) | | Ownership as of Fiscal 2018 Year-End Using Guidelines (in shares) | | Mr. Joly | | 200,000 | | 922,363 | | Ms. Barry | | 55,000 | | 77,875 | | Ms. Ballard | | 55,000 | | 69,869 | | Mr. Mohan | | 55,000 | | 77,854 | | Mr. Nelsen | | 35,000 | | 83,477 |

Tax Deductibility of Compensation. Until recently, Section 162(m) | (9) | The amount reflects an outstanding performance share award assuming a maximum payout (150% of the Internal Revenue Code ("Section 162(m)") has limitedtarget grant). The number of shares ultimately earned will be based on the deductibilityperformance of compensation in excess of $1 million paidour stock’s total shareholder return, relative to the chief executive officerS&P 500 Index, over the 36-month period commencing on January 29, 2017, and eachending on February 1, 2020. As of the end of fiscal 2019, performance was at the maximum payout level for these shares. |

| (10) | The amount reflects an outstanding performance share award assuming a maximum payout (150% of the target grant). The number of shares ultimately earned will be based on the compound annual growth rate of our three most highly compensated executive officers (other thanenterprise revenue, over the chief financial officer), unless the compensation qualifies as "performance-based compensation." The Tax Cuts36-month period commencing on January 29, 2017, and Jobs Act of 2017 amended Section 162(m) with respect to fiscal years beginning after December 31, 2017 to remove the performance-based compensation exception and expand the scope of Section 162(m) to apply to our chief financial officer and certain other NEOs, other than in the case of certain arrangements in place as of November 2, 2017, which qualify for transition relief. The Committee has historically attempted to structure its compensation arrangements to achieve deductibility under Section 162(m)ending on February 1, 2020. As of the Internal Revenue Code, unless the benefitend of such deductibilityfiscal 2019, performance was considered by the Committee to be outweighed by the need for flexibility or the attainment of other objectives. As was the case prior to the enactment of the Tax Cuts and Jobs Act, the Committee will continue to monitor issues concerning the deductibility of executive compensation. We do not, however, make compensation decisions based solely on the availability of a deduction under Section 162(m). Accordingly, we expect that at least a portion of the compensation paid to our NEOs in excess of $1 million per officer will be non-deductible.

For purposes of Section 162(m), we created a sub-plan under our 2014 Omnibus Incentive Plan for our fiscal year ended February 3, 2018. The sub-plan sets the maximum award poolpayout level for the CEO and three other NEOs (excluding the CFO) at 5 percent of adjusted net earnings to align compensation with shareholder interests. The maximum potential individual allocations from that pool were set at 2 percent for the CEO and 1 percent for each of the three other NEOs (excluding the CFO). The Committee then used negative discretion to reduce the amounts that were potentially payable under the sub-plan award pool to equal amounts based on achievement of STI plan metrics.

Clawback and Restrictive Covenant Provisions. All STI and LTI awards granted to our NEOs are subject to our clawback policy. The triggers for potential recoupment of such awards include breach of the restrictive covenants in our long-term incentive award agreements, breach of our Code of Business Ethics, and issuance of a financial restatement as a result of fraud or misconduct. We also include confidentiality, non-compete, non-solicitation and, in select situations, non-disparagement provisions in our long-term incentive award agreements.

Prohibition on Hedging and Pledging Company Securities. We prohibit all employees, including NEOs, and members of the Board from hedging Company securities, including by way of forward contracts, equity swaps, collars, exchange funds or otherwise. In addition, our executive officers and Board members are prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan.

Compensation and Human Resources Committee Report on Executive Compensation

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended February 3, 2018, and in this proxy statement.

COMPENSATION AND HUMAN RESOURCES COMMITTEE

Russell P. Fradin (Chair)

Lisa M. Caputo

J. Patrick Doyle

Kathy J. Higgins Victor

Compensation and Human Resources Committee Interlocks and Insider Participation

The Compensation Committee is comprised entirely of independent directors. At no time during fiscal 2018 was any member of the Compensation Committee a current or former officer or employee of the Company or any of its subsidiaries. During fiscal 2018, no member of the Compensation Committee had a relationship that must be described pursuant to SEC disclosure rules on related party transactions. In fiscal 2018, none of our executive officers served on the board of directors or compensation committee of another company that had one or more executive officers serving on our Board or Compensation Committee.

Compensation of Executive Officers

Summary Compensation Table

The table below summarizes the total compensation earned by each of our NEOs during fiscal 2018 and the two preceding fiscal years (if applicable). There were 53 weeks in fiscal 2018 as compared to 52 weeks in fiscal 2017 and fiscal 2016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | |

Salary(1) | | Stock Awards(2)(3) | | Option Awards(2) | | Non-Equity Incentive Plan Compensation(4) | | All Other Compensation(5) | | Total |

| Hubert Joly Chairman and Chief Executive Officer | | 2018 | | $ | 1,286,058 |

| | $ | 8,644,644 |

| | $ | 2,198,462 |

| | $ | 4,602,983 |

| | $ | 28,307 |

| | $ | 16,760,453 |

| | | 2017 | | 1,175,000 | | 7,689,879 | | 1,800,076 | | 2,878,750 | | 494,275 | | 14,037,980 | | | 2016 | | 1,175,000 | | 8,011,688 | | 1,842,715 | | 3,814,050 | | 68,670 | | 14,912,123 | Corie S. Barry(6) Chief Financial Officer | | 2018 | | 764,423 |

| | 2,008,397 |

| | — |

| | 2,057,625 |

| | 8,203 |

| | 4,838,648 |

| | | 2017 | | 713,462 | | 1,689,495 | | — |

| | 1,184,167 | | 14,893 | | 3,602,017 | | | | | | | | | | | | | | | | Shari L. Ballard President, Multi-Channel Retail | | 2018 | | 859,616 |

| | 3,012,512 |

| | — |

| | 2,309,113 |

| | 24,367 |

| | 6,205,608 |

| | | 2017 | | 800,000 | | 1,930,865 | | — |

| | 1,470,000 | | 62,737 | | 4,263,602 | | | 2016 | | 790,385 |

| | 2,672,270 |

| | 1,228,476 |

| | 1,927,311 |

| | 24,641 |

| | 6,643,083 |

| R. Michael Mohan Chief Merchandising and Marketing Officer

| | 2018 | | 866,346 |

| | 3,012,512 |

| | — |

| | 2,331,975 |

| | 22,907 |

| | 6,233,740 |

| | | 2017 | | 833,654 | | 2,895,073 | | — |

| | 1,531,251 | | 55,284 | | 5,315,262 | | | 2016 | | 790,385 |

| | 1,336,135 |

| | 614,238 |

| | 1,927,311 |

| | 10,323 |

| | 4,678,392 |

| Keith J. Nelsen General Counsel and Secretary

| | 2018 | | 697,885 |

| | 1,656,905 |

| | — |

| | 1,249,817 |

| | 22,507 |

| | 3,627,114 |

| | | 2017 | | 650,000 | | 1,592,960 | | — |

| | 796,250 | | 68,761 | | 3,107,971 | | | 2016 | | 640,385 |

| | 1,102,314 |

| | 506,742 |

| | 1,027,899 |

| | 10,482 |

| | 3,287,822 |

|